Is Singapore’s currency (SGD) gaining in resilience? The conventional wisdom is that it is not, and that further depreciation is inevitable.

This bleak view is premised on :

(1) the widespread expectation of further CNY weakness –which, as China has become everyone’s largest trading partner now, should place more pressure on regional currencies;

(2) most newly industrialized economies (or the NIEs) have taken on a lot of private debt and on account of their -economic openness, as well as – USD linked currency regimes, they are bound to import tightening monetary policies from the Fed, and which should necessitate more FX weakening; and

(3) finally, these currencies (including SGD) remain cheap to short and, indeed, short-positioning by investors remains quite heavy.

Indeed, these are powerful and well established drivers of expecting further FX weakness in East Asia.

Moreover, they do not even begin to incorporate additional risks –of trade protectionism, border taxes, and repatriation of corporate assets–unleashed by the ‘America First’ policies of the new U.S. administration.

In this backdrop, we are not arguing that SGD will appreciate against the USD. But it should hold up better than other East Asian currencies on account of three idiosyncratic, but, fundamental reasons.

The first reason is the improving flow picture in the country’s balance of payments. This is the result of thinning banking and portfolio outflows whilst the current account surplus has actually grown fatter. The end of the CNH carry trade in particular is slowing foreign currency lending by Singaporean banks and improving USD liquidity. Moreover, tighter lending conditions have also lowered SGD loan-to-deposit ratios and shored up overall liquidity.

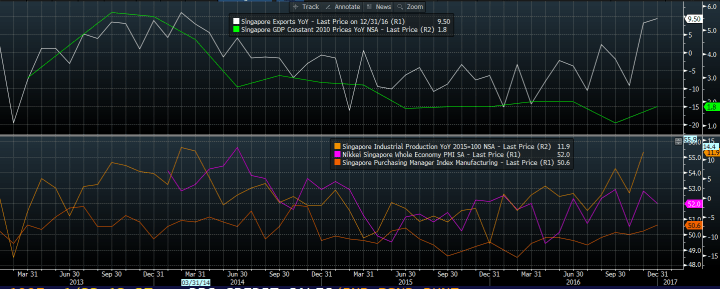

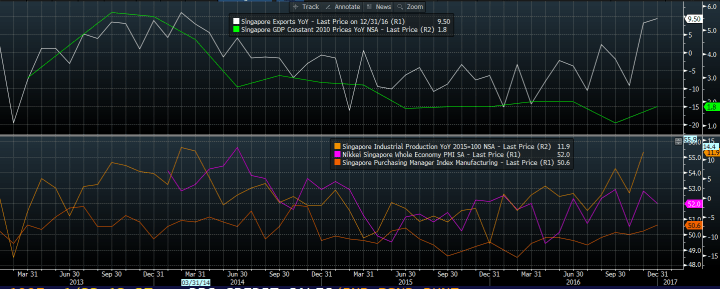

Secondly, the growth downturn in Singapore is bottoming out –albeit conviction around an imminent upturn remains weak. Singaporean growth has surprised on the upside in recent months, and exports, production and PMIs have edged higher –signaling firming activity. If, as we expect, the bottoming out story is true –even if it is a ‘long bottom’– then any remaining expectations of further easing by MAS –for instance, by a level shift lower (i.e., a depreciation) of the SGD NEER band– should begin to be squeezed out.

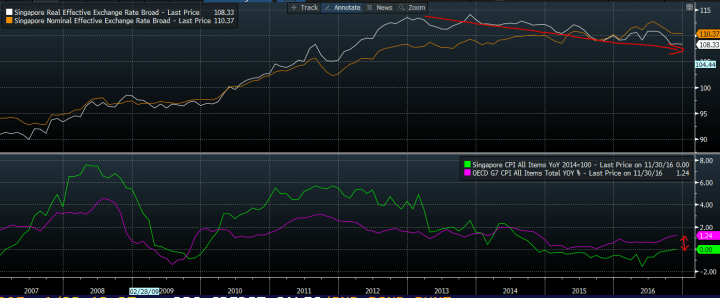

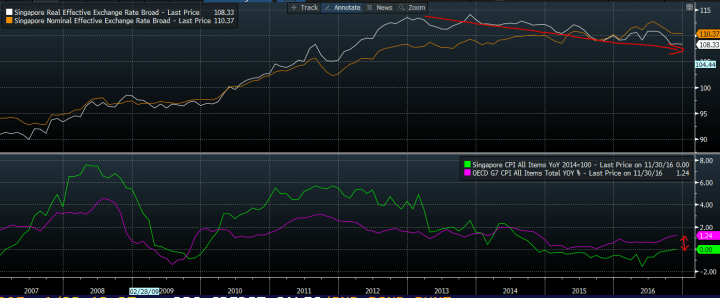

Finally, Singapore’s headline inflation –has pipped up from deflation, but– remains lower than inflation rates at most advanced countries. We expect this negative inflation differential to persist for some time and gradually restore currency competitiveness. Why? Because lower domestic inflation raises the relative attractiveness of domestic goods and services in comparison to foreign imports of the same. Singapore, therefore, does not need a great deal of nominal FX depreciation to regain external competitiveness.

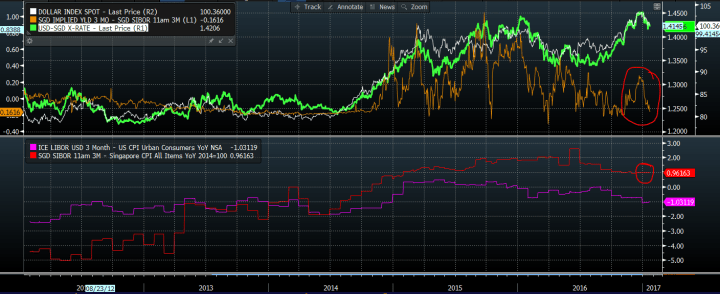

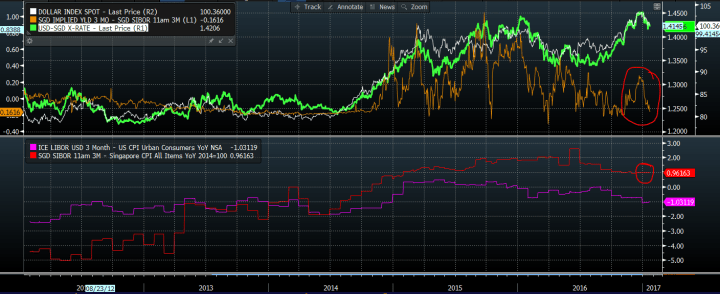

In fact, the market has begun pricing this in. The gap between Singapore’s 3 month interbank rate and 3 month U.S. Libor has closed and forward premiums are now much calmer amid continuing episodes of USD strength.

So that’s our analysis. We would submit that SGD will weaken in tandem with USD strength but no more. If GDP growth delivers a few upward surprises, it may even outperform the USD by a small margin!

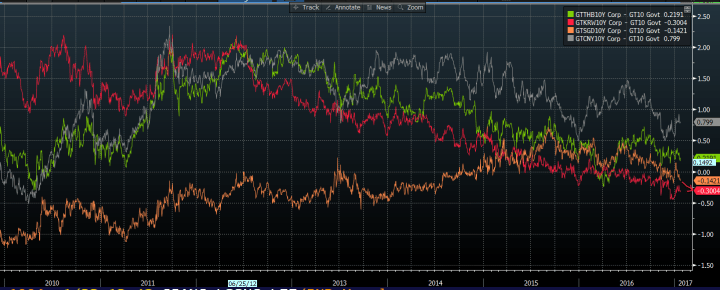

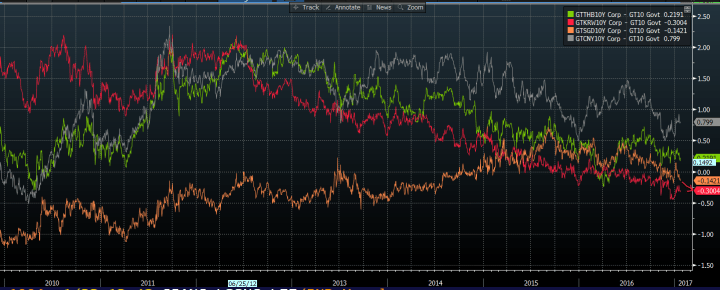

In this environment, we wouldn’t place out-sized shorts on the SGD and even prioritize more yield compression in the long-end of Singaporean Government bonds. Over the past 7-8 years, up until mid 2014, 10-year SGS yields have traded a good 0.5% to 1% inside US Treasuries. We see no reason why SGS yields cannot go to around 0.3% or 0.4% inside equivalent USTs within the next 3-6 months –they’re currently only around 10-12bps tighter.

What about Trump risks, you say? Sure those are relevant. But here’s where our philosophy kicks in. We think the Trump administration needs consistency and discipline to fructify its stimulus and protectionist agenda. The chaos and compromise, and the watering down, which will undoubtedly follow, in our view, will take the edge out of Trump related risks to the currency and rates outlook for Singapore.

Chart 1: Activity indicators are beginning to stabilize, and turn higher…

Chart 2: Gradual depreciation of real effective rate of SGD should continue on lower inflation than at trading partners…

Chart 3: USDSGD trends still running in tandem with broad USD index, but currency pressure (ST forward premiums) are much better behaved…

Chart 4: SGS 10Y bond yields should trade 30-40bps through equivalent UST yields, in 3-6 months time…